Time Zones and Trading – Capitalizing on Profits in the Forex Market

Inside the speedy-paced realm of the Forex market, learning the intricacies of your energy areas could be an essential consider making the most of benefits. The Forex market operates twenty-four hours a day, several times every week and spanning distinct time zones across key financial centers globally. This continual accessibility features traders with exclusive possibilities to exploit cost variances and influence time area differentials for their benefit. One of the more significant features of the Forex market’s continuous operation is the capability to trade during a variety of world-wide trainings. The market starts up together with the Sydney program, accompanied by the Tokyo, London, uk and New York City sessions, each with its own distinctive features and trading quantities. For traders looking to maximize results, it is crucial to distinguish the overlaps between these periods. The highest overlap is between the London, uk and New York trainings, which happen in the morning hours’ time of such individual towns. This period, is also known as the glowing hours, witness’s higher liquidity and increased volatility, giving ample trading options.

Tactical preparing close to time zones can also help traders optimize their trading daily activities. For example, traders can select to pay attention to specific money pairs throughout their most energetic trading hrs. During the Asian program, traders might give full attention to currency pairs involving the Japanese Yen, even though the European period may lead to increased moves in Euro-dependent sets. By aligning their trading pursuits with all the most productive periods for his or her selected currency exchange sets, xtrade review can boost their chances of catching substantial value movements and creating lucrative trades. Additionally, being familiar with time zone differentials can assist traders in looking forward to market-relocating events and economical announcements. By checking the making of economical info and main news situations across various time zones, traders can place themselves to maximize unexpected market shifts. By way of example, a forex trader in Asia can get prepared for prospective market unpredictability brought on by an important announcement in the Western or Us marketplaces, changing their positions accordingly.

Nevertheless, it is important to remember that whilst time zone differentials supply considerable benefits, additionally they come with threats. The market’s 24/5 functioning ensures that traders have to deal with their time successfully in order to avoid burnout. The constant option of trading can result in overtrading, which could bring about losses as opposed to results. Making a properly-set up trading program that also includes selected trading time, threat control methods and constant studying is crucial to succeed in the Forex market. To summarize, perfecting the ability of trading within the Forex market requires not only comprehending graphs and technological signs. Knowledge of international timezones as well as their effects on trading action is powerful tools that can help traders increase benefits. By strategically aligning trading trainings with money match action, keeping informed about market-transferring events and maintaining self-control, traders can funnel the chance of time area differentials to create an excellent Forex trading quest.

Unlocking New Horizons in Financial Markets with Xtrade

In today’s rapidly evolving financial landscape, the ability to navigate the complexities of global markets has become more critical than ever. Investors and traders are constantly seeking innovative solutions that provide them with an edge, and one such platform that has been making waves is Xtrade. With its user-friendly interface, extensive range of assets, and cutting-edge trading tools, Xtrade is unlocking new horizons in financial markets for both novice and experienced traders.

Diverse Asset Selection: One of Xtrade’s standout features is its vast selection of tradable assets. From the traditional equities, forex, and commodities to cryptocurrencies and indices, Xtrade offers a comprehensive array of financial instruments. This diversity empowers traders to diversify their portfolios and explore opportunities in various markets, thereby reducing risk and enhancing their chances of profit.

User-Friendly Platform: Xtrade’s platform is designed with the trader’s ease of use in mind. The intuitive interface ensures that even newcomers to the world of trading can quickly grasp the basics and start trading confidently. For experienced traders, the platform’s advanced features, such as technical analysis tools and customizable charts, allow for in-depth market analysis and informed decision-making.

Risk Management: Xtrade understands that managing risk is paramount in financial markets. To that end, the platform provides a range of risk management tools. These include stop-loss and take-profit orders, allowing traders to set predefined exit points to limit potential losses and secure profits. Additionally, Xtrade offers negative balance protection, ensuring that traders never lose more than their initial investment.

Educational Resources: Xtrade goes the extra mile to support its users’ growth as traders. The platform offers an extensive library of educational resources, including video tutorials, webinars, and articles. These resources cover a wide range of topics, from the basics of trading to advanced strategies, enabling traders to continuously improve their skills and stay updated on market trends.

Customer Support: Xtrade prides itself on its exceptional customer support. Traders can reach out to the support team 24 or5 through various channels, including live chat and email. The responsive and knowledgeable support staff is readily available to assist with any queries or issues, ensuring a smooth trading experience.

Regulated and Secure: Xtrade is fully regulated, providing traders with confidence in the platform’s legitimacy and adherence to strict financial regulations. Furthermore, the platform employs state-of-the-art security measures to protect users’ sensitive information and funds, ensuring a safe and secure trading environment.

Mobile Trading: In today’s fast-paced world, traders often need the flexibility to trade on the go. Xtrade’s mobile app allows traders to access their accounts and execute trades from anywhere with an internet connection, providing convenience and flexibility.

In conclusion, xtrade review is making waves in the financial markets by offering a comprehensive, user-friendly platform that caters to the needs of traders at all levels. Its diverse asset selection, risk management tools, educational resources, and excellent customer support make it a standout choice for those looking to unlock new horizons in their trading journey. Whether you are a seasoned trader or just starting, Xtrade offers the tools and support to help you succeed in the dynamic world of financial markets.

Winning with Leverage – The Art of Responsibly Amplifying Forex Trades

In the dynamic realm of foreign exchange trading, mastering the art of leverage can be the key to unlocking substantial gains. Leverage, in essence, allows traders to control a larger position size with a smaller amount of capital, magnifying both potential profits and losses. However, this powerful tool must be wielded with utmost responsibility and a deep understanding of the associated risks to truly succeed in the forex market. Leverage serves as a double-edged sword, offering the potential to multiply gains exponentially while also heightening the exposure to losses. Novice traders often fall into the trap of overleveraging, seduced by the allure of quick riches. Yet, seasoned traders recognize that employing leverage necessitates a meticulous approach. Proper risk management becomes paramount, as maintaining a clear grasp of one’s risk tolerance can prevent catastrophic losses that can wipe out trading accounts. Successful traders employ risk-reward ratios and position sizing strategies that align with their overall trading objectives, shielding them from the adverse effects of impulsive trading decisions.

Educating oneself about the intricacies of leverage is the cornerstone of responsible trading. A comprehensive understanding of how leverage functions, margin requirements and margin calls empowers traders to make informed decisions. Moreover, leveraging demands an in-depth comprehension of technical and fundamental analysis. Astute traders harness their knowledge to identify high-probability xtrade review, ensuring that leverage amplifies well-reasoned positions rather than reckless gambles. Additionally, leveraging demands a steadfast emotional discipline. The amplified volatility that comes with leveraged trades can trigger intense emotional reactions, clouding judgment and leading to hasty decisions. Seasoned traders emphasize the importance of maintaining a rational mindset, even in the face of rapid market fluctuations. Implementing stop-loss orders and adhering to pre-established trading plans can serve as effective mechanisms for curbing emotional trading and promoting consistent, level-headed decision-making.

Successful navigation of leveraged forex trading hinges on continuous learning and adaptation. Markets are perpetually evolving, influenced by a multitude of factors ranging from geopolitical events to economic indicators. Staying updated on market trends and refining trading strategies are indispensable components of remaining competitive. Seasoned traders continually fine-tune their methods, integrating new insights to optimize their leverage-based trading approach. In conclusion, mastering the art of responsibly amplifying forex trades through leverage requires a multifaceted approach. A robust grasp of risk management, technical and fundamental analysis, emotional discipline and ongoing learning are all essential elements. By embracing leverage as a tool to enhance calculated trades rather than a vehicle for recklessness, traders can unlock the full potential of the forex market while safeguarding their capital. In this high-stakes arena, success lies not just in winning trades, but in the astute and prudent application of leverage.

Successful navigation of leveraged forex trading hinges on continuous learning and adaptation. Markets are perpetually evolving, influenced by a multitude of factors ranging from geopolitical events to economic indicators. Staying updated on market trends and refining trading strategies are indispensable components of remaining competitive. Seasoned traders continually fine-tune their methods, integrating new insights to optimize their leverage-based trading approach. In conclusion, mastering the art of responsibly amplifying forex trades through leverage requires a multifaceted approach. A robust grasp of risk management, technical and fundamental analysis, emotional discipline and ongoing learning are all essential elements. By embracing leverage as a tool to enhance calculated trades rather than a vehicle for recklessness, traders can unlock the full potential of the forex market while safeguarding their capital. In this high-stakes arena, success lies not just in winning trades, but in the astute and prudent application of leverage.

Senior Citizens and FHA Loans – Process out the Options for Retirees

As senior citizens transition into retirement, financial considerations often become more complex. One important aspect of their financial landscape can be homeownership and the ways in which they can access funds for home-related expenses. For many retirees, Federal Housing Administration FHA loans present an appealing option. FHA loans are a type of mortgage designed to assist individuals with lower credit scores or limited down payment capabilities in becoming homeowners. While traditionally associated with first-time homebuyers, FHA loans also offer potential benefits to senior citizens looking to manage their housing costs during retirement. One of the key advantages of FHA loans for seniors is the relatively lenient eligibility criteria. These loans require a lower credit score compared to conventional loans, which can be especially beneficial for retirees who may have seen fluctuations in their credit over time. Additionally, FHA loans have lower down payment requirements, potentially allowing seniors to access funds without depleting their savings.

Another notable feature of FHA loans is their reverse mortgage option, known as the Home Equity Conversion Mortgage HECM. This is an appealing choice for retirees who have substantial equity in their homes but want to access that equity without selling the property. HECM allows seniors to convert a portion of their home equity into cash, providing a steady stream of income during retirement or a lump sum for specific expenses. It is worth noting that reverse mortgages have eligibility requirements, including the borrower being at least 62 years old and using the home as their primary residence. However, seniors considering FHA loans should also be aware of potential drawbacks. FHA loans come with mortgage insurance premiums MIPs, which can increase the overall cost of the loan. Additionally, while the lower credit score requirement is advantageous, it can result in higher interest rates compared to conventional loans. This means that over the life of the loan, seniors might end up paying more in interest.

Before committing to an FHA loan, senior citizens should thoroughly assess their financial situation and long-term goals Shred Mortgage. It is essential to consider factors such as the length of time they plan to stay in the home, their monthly budget, and whether they want to leave the home as an inheritance to their heirs. In conclusion, FHA loans provide senior citizens with viable options for managing their housing costs during retirement. The accessibility of these loans, particularly through the HECM program, can enable retirees to tap into their home equity without the need to sell their property. However, seniors should carefully weigh the benefits and drawbacks of FHA loans, including the impact of MIPs and potentially higher interest rates. Consulting with financial advisors and mortgage professionals can help seniors make informed decisions tailored to their unique circumstances, ultimately leading to a more secure and comfortable retirement living situation.

Discover the Benefits of Zisman Tax Service for your Businesses

Zisman Tax Service offers a multitude of benefits to individuals and businesses seeking professional tax assistance. With their extensive expertise and commitment to client satisfaction, Zisman Tax Service stands out as a trusted partner in navigating the complexities of taxation. One of the key benefits of working with Zisman Tax Service is their deep understanding of tax laws and regulations. They stay up to date with the latest changes, ensuring that clients receive accurate and compliant advice. By keeping abreast of tax code updates, Zisman Tax Service helps clients maximize their tax benefits while minimizing the risk of penalties or audits. This comprehensive knowledge allows them to provide tailored strategies that align with each client’s specific financial situation and goals. Zisman Tax Service’s commitment to personalized attention is another distinct advantage. They take the time to listen and understand each client’s unique circumstances, enabling them to provide customized solutions that address individual needs.

Whether it is optimizing deductions, exploring tax credits, or strategizing for long-term tax planning, Zisman Tax Service ensures that clients receive personalized advice and guidance. Their attentive approach fosters a strong client-advisor relationship, instilling confidence and trust in their services. Accuracy and attention to detail are at the core of Zisman Tax Service’s operations. They understand the potential consequences of errors or omissions in tax filings, and as such, they prioritize thoroughness in every aspect of their work. Zisman Tax Service’s meticulous review process minimizes the risk of mistakes, ensuring that tax returns are prepared accurately and on time. This attention to detail gives clients peace of mind, knowing that their taxes are being handled with the utmost care and precision. Another notable benefit of choosing Zisman Tax Service is their commitment to proactive tax planning. Rather than focusing solely on the present tax year, they help clients develop long-term strategies to optimize their tax positions. By considering future financial goals and potential tax implications, Zisman Tax Service helps clients make informed decisions that can lead to significant tax savings over time and view the site https://www.zismantax.com/services/form-8865/. Their proactive approach reflects their dedication to maximizing clients’ financial well-being beyond just the immediate tax season.

Furthermore, Zisman Tax Service provides exceptional customer service throughout the entire engagement. Their responsive and knowledgeable team is readily available to address client inquiries, concerns, and changing tax circumstances. Zisman Tax Service understands the importance of clear communication and timely support, ensuring that clients feel valued and supported every step of the way. In conclusion, Zisman Tax Service offers a range of benefits that make them an ideal partner for individuals and businesses seeking professional tax assistance. Their expertise in tax laws, personalized attention, accuracy, proactive tax planning, and exceptional customer service set them apart. By choosing Zisman Tax Service, clients can experience the advantages of working with a trusted tax advisor who is dedicated to their financial success and peace of mind.

What Exactly Are Time Same-day loan Service? – Home Based Goal

Time same-day loans are received loans that happen to be available in a brief measure of time. A lot of the time you happen to be approached to offer importance or security to the loan. This is certainly concluded to guard reimbursement from the cash obtained. You could suppose that possessions are confined when you are searching for same-day loans. This anyway is not really correct. There are several spots available on-line to acquire loans from. Moneylenders may question how the single fulfill specific steps when they are trying to get the loan. Not all on the web banking companies offer these loans; be that as it can certainly, the quantity of the individuals who is able to is developing at the troubling rate.

You could find it for some diploma difficult to hunt down a moneylender that packages your needs in general. Make sure that to find close to before deciding on any bargain. There might be financial institutions which will work together with anyone to assure your specific requirements are met. Although implementing on the web you will be backed close to the same time frame that your program was submitted. About the away from chance you are not guaranteed instantly, you might get an e-mail to inform you reasons why you had been not backed. On a regular basis you could simply need to give a little more info.

You should demand all the data readily available concerning the deals of your loan you happen to be applying for. With the stage whenever you utilize on-line these arrangements are routinely offered to yourself on an aspect bar or with the decrease portion of the website landing page from the company. When you cannot obtain the contracts you may need to desire the info in the firm preceding making use of. While looking on-line 대출 you will have to contrast the records you happen to be able with get when talked about from your organization. Contrasting a number of organizations may well encourage you to find the organization that may satisfy your requirements the ideal. Moment same-day loans exist as being a convenience for the client. You will get the loan within the briefest way of measuring time that anyone could want to locate.

You may not always in every scenario have to accept to the principal firm which offers you the best price you may have noticed. A lot of agencies will either go with or beat the paces of the competition. Banking companies who bargain loans on the web are expanding in phone numbers, therefore they are persistently available for business. The very best benefit of implementing on the web is enhanced comfort. You can get a loan no sweat. You do not must uphold time or even a while as you might with nearby loan gurus. A couple of loan professionals deal with you in accordance with the problems and conditions and just let you get what you could keep the fee for constantly.

When Do Hard Money Business Home loan Loans Approval Appear to be legit?

Furtively sponsored, consistently called hard money business contract loans normally pass yearly funding expenses of on more than 10% and charge starting motivations behind 2%-4%. Such rates and terms might give off an impression of being restrictive, yet when the situation calls for it, taking advantage of private loaning is a sharp business move.

Right when There is not a moment to spare

In the business land game time truly is money. Experienced land proprietors, examiners and planners will uncover to you that regularly speed of execution can best loan charges and core interests. While standing up to an oncoming purchase elective exile date, a forthcoming inflatable portion that is coming due speedy, a surprising expense overpower or more unfortunate, a surrender circumstance experts do not have the potential chance to hold up the 60-90 days it can take to close a conventional bank advance. Deplorably, there are times when your property or you expect are on the line and endlessly out smart money can deal with your anxiety. Hard money loan experts can make the-spot decisions and can close rapidly. Multi week funding is very much possible and any authentic private bank can settle basically any exchange in less than 3 weeks. Hard money is decently expensive yet it is a damnation of significantly more reasonable than losing your game plan.

Right when you have Credit or Documentation Issues

Customary Look at the post here experts will request a great deal of documentation and that the borrower has better compared to average credit and you could check this https://advancefunding-partners.com/services/small-business-loans/. Regardless, land financial experts should make 3 years charge records, advantage and disaster verbalizations, copies of leases, bank decrees, building support records and significantly more. Nuances will be checked and a game plan can be butchered on account was not spotted or a T that was not crossed. Private loans, on the other hand, are ordinarily esteem based and not driven by the nature of the borrower. Your credit may not have any effect in any way shape or form. Hard moneylenders do not have the organization and the rules that banks, Money Road and the protection offices do.

Right when you want To Make an Appealing Proposition

Money is at this point master and having a trustworthy hard moneylender in your gathering looks like money in the bank. In case you tell a seller you can close on an award piece of property in 10 days with all money, you will get those vendors thought. Your resistance is probable mentioning a multi-day due resourcefulness period and as-much-as 60 days to close. In case you can set up legitimacy with a dependable private bank and you fathom what their development measure is, you can propose with sureness and the money to back it up.

Go Ahead Better Future with Gold Individual Retirement Account

We in general love to go on get-away and we lock in for them. We for the most part plan months or even a year or so early on for that special event. We could go to a tough spot just to get the best buys around and advance tickets if fundamental. A retirement account should be managed in basically the same manner as an exceptional outing. There is a lot of preparation and planning that ought to go into the future days to come. Things, for instance, where you will be the place where you leave and how might you plan on wrapping up of your life should be all around a piece of the decisions you ought to make when you are more energetic and in the cash the board decisions. This article will offer tips on a part of what to plan for, and how to prepare for retirement.

Many positions will offer an IRA account as a benefit. This individual retirement account can be set up in various ways that will provoke more money for your future. You can save a particular proportion of money each month that would go into a retirement account. This money would be set up so it would begin creating with income or hypotheses, so you can twofold and triple your money contributed. Many positions will place a particular proportion of money consistently into an account for you, or on occasion, they will match what you place into the retirement account. There are places you can go for urging in setting up a retirement account and they can take care of your money for you or let you know the most effective way to get it going. There are lots of individuals who get into confusion while picking the sort of individual retirement accounts as both of them appreciate benefits. It is basically an issue of individual choice which should be taken after significant investigation and thought.

If you are not particularly clear about these individual retirement accounts, then you can take help from a subject matter expert and ask him for their thoughts. While setting up a retirement account you will have various fascinating focuses for your future. How much money will this get when do leave. Will it be adequate, or would I like to have more than one kind of retirement account set up. What kind of things should do at the hour of retirement and the number of those things that will cost. Might you anytime buy a home now that you could have paid for when you show up at the time of retirement. This would not simply be an endeavor, but your above expenses would be less so you could really do and spend more not long from now. A retirement account could put a bit of a snack on your younger lifestyle, your retirement account will have been worth the compensation and go now https://goldiracompanies.co.

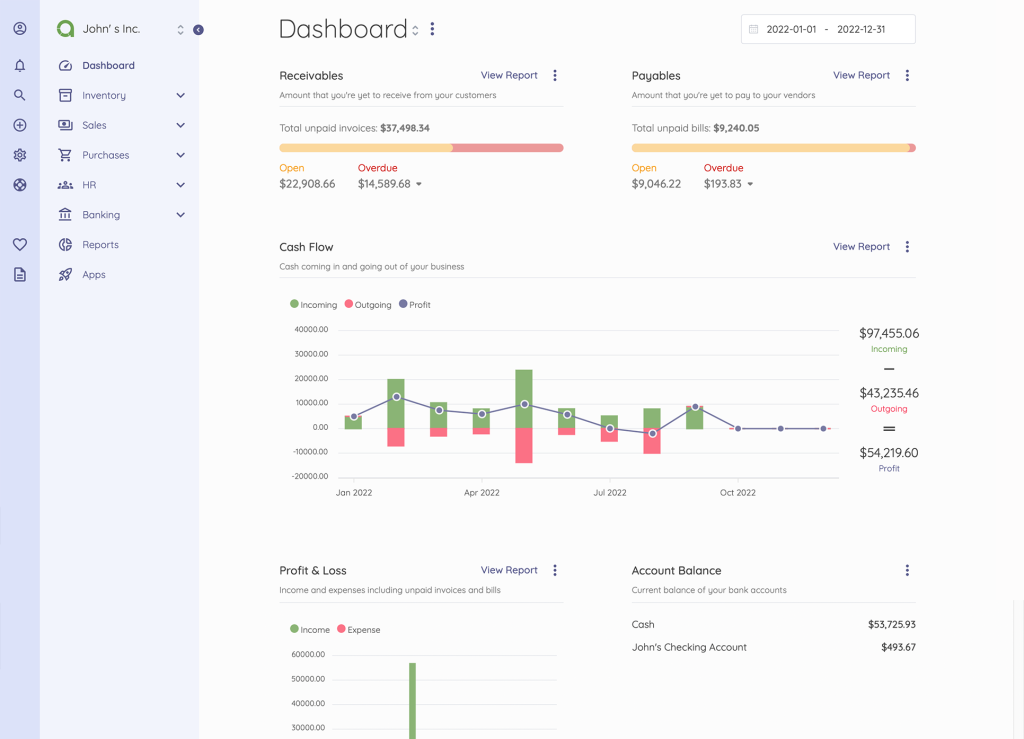

Online Accountancy Software Can Assist Your Business with a Great Deal

While considering working on your business, whether monster or small, you should begin right from your finance division. Right when the financial office is exact to the degree that presentation, then, it turns out to be especially clear for the business to flourish. The affiliations have accounting divisions while others find it more useful to outsource online accounting software thinking about different factors. The services presented by accountancy firms and experts can be moreover pretty much as uncommon as having your in-house accountant and they oblige all that from finance to trouble and different accounts related errands. As a rule, online accounting software is chosen by medium and small evaluated tries and they go with the various benefits. Various benefits of enrolling the online services review lessened costs for office equipment. Adjacent to getting, major areas of strength for ideal financial services, using accountancy specialists saves crucial time and expenses for businesses.

Cost attainability- It is one of the benefits that businesses appreciate when they enlist the services. It will overall be extreme to select a full time delegate or accountant stood apart from enrolling services that you really care about. Small businesses take part in the additional time and assets that can assist with extra making capability when they enlist the online accounting software. In actuality, there are various accountancy firms offering the truly fundamental services by various kinds of businesses. It gathers you should be careful while using the accountants with the objective that you can get the best for your business needs.

Validation and industry experience- This is the kind of thing you ought to try to check while enlisting online accounting software. Several limits can be exceptional to a business locale and essentially a developed accountant can proceed precisely true to form. Guarantee that you get a firm that has ensured organized and experienced accountants and delegates.

Quality certificate assessments- You enlist since there are center capacities you need in any case need likewise you ought to get simply eminent. A good firm ought to be totally taught with respect to late obligation rules and any administrative changes so your necessities are met adequately. Figure out how the firm guarantees that you get quality services as shown by the specific online accounting software you are searching for.

Adaptability- The mystery ought to be to use a firm or an accountant your business can depend upon when the need emerges. For example, a firm that can offer web or cloud-based services despite the way that it very well may be nearby can be best for such occasions when you really need to get to your financial information frantically.

To get the best online Accountancy Software, you could have to explore and contemplate firms going before making due with the one you consider usually reasonable for your business. You can in this way consider the service rates just to ensure that using is emphatically the better strategy for taking.

The Essential Role of Business Schools Ranking In Modern World

Whether managers are conceived or made is debatable inquiry. Certain individuals say managerial abilities are innate and others say these abilities can be acquired. In both the cases, the job of a business school is crucial. Regardless of whether an individual has abilities acquired from ancestors, necessities to clean them according to the times he lives and operates in. Here, management education plays an important job. It directs the individual about where and how to apply his abilities. In the other case, business schools help to foster managerial abilities. They update their educational plan according to the circumstances shaping up in the external business world. Updated information is what keeps one ahead. Indeed, even after acquiring ample information about management in some cases what matters in an organization is the degree, which can be acquired exclusively from a decent business school.

Business schools are a gateway to the corporate world. Management abilities backed up by a degree can assist with moving up in progress in one’s career much easier. You want to know your area of specialization before joining a business school. There are referred to specializations like human resource, marketing, finance, and operations however organizes these days are thinking of detailed courses which incorporate subjects like digital marketing, internet business, retail management, production network management, and so forth. These specializations assist the students with getting a detailed understanding of the working of each and every field. Business schools give post-graduate as well as undergraduate courses. Working professionals can take the advantage of part-time courses. Distance education is also available for a portion of the courses. Presently a-days everybody aspires for management education because it enhances an individual’s marketability in the corporate world.

With a management degree, one can apply for a higher post or can anticipate faster advancement in the near future. The degree can make a remarkable contrast to the salary package advertised. With regards to the increasing demand for management schools, the stock has also increased. Be that as it may, choosing a right school is really a task. Apart from information and experience, the name and ranking of the management school also matters in the business market. In the case of everything appears to be feasible, really at that time would it be a good idea for one selects a particular business school. Business schools have an important job in today’s corporate business world for the people who aim to achieve higher career goals. Simple graduation has almost no value in the ongoing scenario. One has to acquire a post-graduate degree to try and qualify into the cutthroat race. At the point when it is related to a career in management, a degree from a decent management school has almost turned into a must. The main factors of qs排名 are to direct research into the course, recognize your goals and want and most importantly, visit the school before picking as this can frequently be a major game changer.